Whatever we might be calling that this interim budget as an election budget but it has helped in making extra cash available in the hands of the middle and poor class who constitute the largest section of the population. This should help the growth of some of our processed food products, opines Rajat K. Baisya.

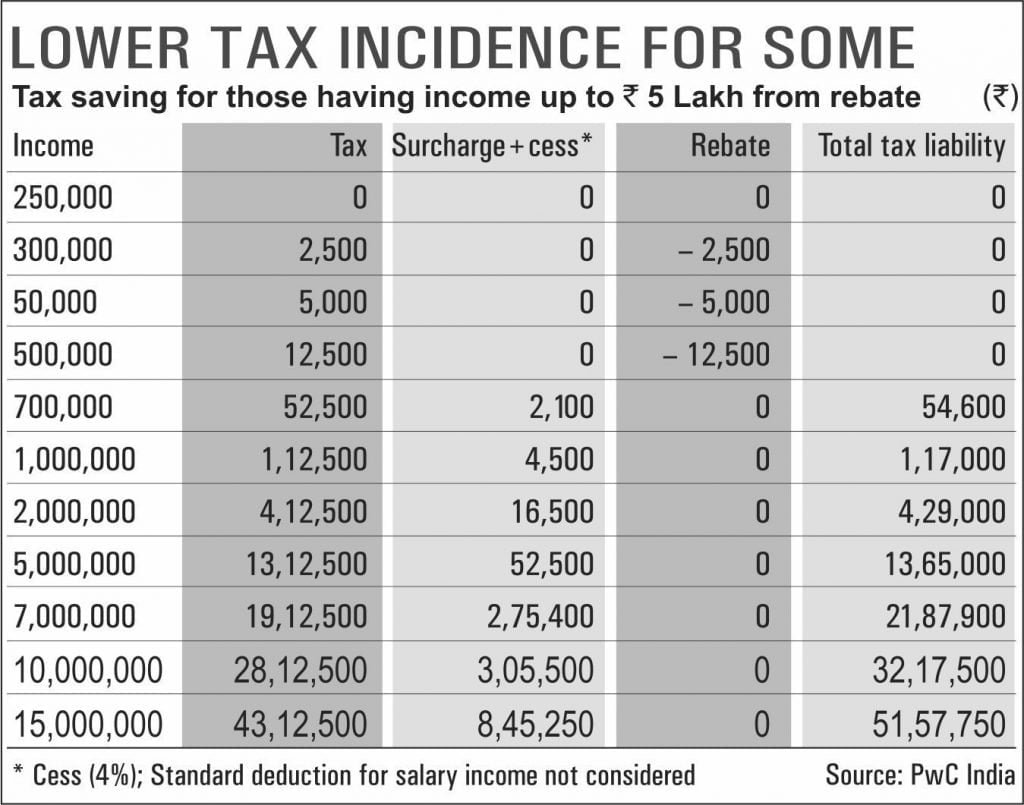

The market seems to have positively reacted to the interim pre-election budget of the government. The reason being higher disposable income with poor and middle class who constitute the largest segment of the consumer market. That there will be no tax on income upto Rs 5 lacs will put additional cash in the hands of the common men. This should help the growth of some of our processed food products. The food processing industry will welcome this move of the government. Processed food is generally considered as a luxury by common men and that has restricted the growth of the industry as a large chunk of the consumers don’t eat ketchup, juices, breakfast cereals and say bakery products. Industry either created a small pack for one-time consumption to attract occasional purchase by lower-income segment to drive volume or focussed on other segments including the institutional market for growth. MSME sector produced products at lower prices.

These attempts have produced limited results and the desired level of growth still evaded the industry. Significant growth is a possibility only when the middle and poor class also start buying and consuming processed food products. The product category which is priced low targeting the poor has distinctively shown high growth and high volume. Take the case of glucose biscuit which is almost 80% of the total biscuit category in terms of volume. Because it is the poor man’s biscuit. Available at a low price point. Poor people even take one packet of ParleG at Rs.5 and one cup of tea as their lunch. No wonder that ParleG is the world’s largest biscuit brand by volume. Although glucose biscuit drives volume contributes about 80 percent of sales of the biscuit manufacturers but the profit contribution from this brand is small. The profit comes from the other speciality biscuits and cookies.

With the higher amount of disposable cash available with the poor and middle-income group of the population, some of the popular categories of the foods including popular snacks as well as dairy products will get a boost in sales. Extra disposable income will be spent on these popular food products. Increasing the growth of processed food products may not be the intention of the government but the taxation provision under the new budget will indirectly help this growth. Consumers will spend on food, entertainment, and fashion based on their affordability.

The other provision also will help small businesses and individuals. The TDS on deposit accounts has also been revised. Earlier TDS of 10 percent was deducted from the interest-earning on fixed deposits in banks if the interest-earning is Rs 10000 and above. This limit now has been raised to Rs 40000 which would mean that upto Rs 40000 interest no TDS is payable. This will also help the middle-income group and small traders.

GST compliance also has been made little business-friendly in the sense that companies upto Rs 5 crores in revenue will have to file return quarterly and not monthly. With the lowering of GST rates for some of the food products recently, the price of those goods should also come down stimulating growth in consumption. Farmers will get Rs 6000 as a direct transfer to their account which will also be an incremental income to be spent on what people would like to buy. Some categories of processed food as I have mentioned like, snacks, savoury, dairy products, bakery, and confectionery products, convenience foods will see some growth as the middle and lower-income group would like to consume these products if they find that they can afford.

This government is lucky that crude oil price is all-time low which has kept inflation at a low level which was not the case during the earlier regime. The prices have not gone up and if now flow of money increases in the hands of the middle and lower-income groups which really can drive volume we should expect that these budget possibly can help and stimulate the growth of the processed food industry.

The interim budget also has made an announcement on significant growth in the provision for the northeast and emphasises on organic agriculture. Northeastern states will, therefore, become a focal point for the food industry’s future investment. Eventually, NE should attract investment in the food processing sector. With infrastructure improving, NE states have all the positive factors that can stimulate the growth of the processed food industry in that region and can eventually emerge as the manufacturing hub for the sector to feed domestic markets as well as for international trade.

North-Eastern states traditionally are practising organic agriculture. Time and again govt is emphasising on organic agriculture and also supporting through some promotional schemes as well as in organic certification and other incentives in terms of participating in trade fairs to promote and market the products of farm sectors. Organic trade should eventually grow.

Even in this interim budget supporting organic production and trade has been mentioned by the finance minister keeping again eye on recent agitation against govt on new citizenship bill. While this can be only announced keeping eye on the next election due in a couple of months’ time but the food industry and organic agriculture will definitely benefit and manufacturers can easily reap the harvest. While organic agriculture will grow but the agricultural growth rate is declining. It has now come down to less than 15% of our GDP.

Whatever we might be calling that this interim budget as an election budget but it has helped in making extra cash available in the hands of the middle and poor class who constitute the largest section of the population and food industry did not grow because products are not affordable to this section. The government might resort to borrowing or divesting PSUs to fund this additional burden of doling out cash which can also increase the interest rates but the process food industry will derive some direct and indirect benefits from this interim budget which was not intended to be a full-scale union budget in any case. Post-election there will be another full-fledged budget when we can see what are the various provision and growth stimulators going to be proposed for the processed food industry and agriculture.